Some Known Details About Home Owners Warranty Insurance

Table of ContentsHow Home Owners Warranty Insurance can Save You Time, Stress, and Money.Our Home Owners Warranty Insurance DiariesThe Buzz on Home Owners Warranty InsuranceHow Home Owners Warranty Insurance can Save You Time, Stress, and Money.Home Owners Warranty Insurance Fundamentals Explained

If you include several enhancements and also upgrades onto your strategy, you could be looking at a yearly expense as high as $1,000 not that much less than the ordinary yearly expense of property owners insurance. Besides the price of the plan itself, you'll have to pay a service charge each time a technician or agreement is sent to your home for analyses or repair services.

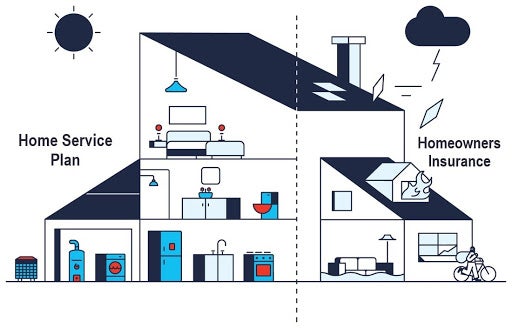

Is residence service warranty insurance coverage worth it? With a residence warranty, you have the comfort of recognizing your house systems and also home appliances are shielded if they stop functioning, and the comfort of not having to look for a service provider or technician each time. However warranties are not always an excellent deal, particularly if you have a more recent home with systems as well as devices still covered under producer or building contractor warranties.

Excitement About Home Owners Warranty Insurance

Some charge card firms and also on-line merchants will certainly also increase the producer's warranty, more decreasing the demand for guarantee protection. The pros of house guarantees, If you're a novice house owner: Warranties are particularly beneficial if you're a novice house owner who might not understand who to call if your air-conditioning quits working one day.

If you stay in an older house: A service warranty may also be a bargain if you stay in a home with older systems and devices. If you're purchasing an older residence, the purchaser's inspection will likely consist of details concerning the age as well as problem of the home's devices (home owners warranty insurance). If the evaluation reveals, say, pipes and electric concerns, it could be extra beneficial to see if the vendor would want to cover the expenses of brand-new systems and also appliances instead than take out a guarantee.

You could already be under maker or contractor guarantee: The majority of new systems as well as devices are under producer's service warranty for anywhere within the first year to 5 years of the purchase day, depending on the source of break down and also exactly what broke. If you stay in a newly-built residence, the home builder's agreement likewise may include a guarantee duration for approximately one decade for systems, plumbing, or electrical problems.

The Facts About Home Owners Warranty Insurance Uncovered

The great feature of tools malfunction insurance coverage is that unlike with house warranties there are few cautions. All systems as well as devices are covered against every little thing from i was reading this improper setup to electrical failure. The only cause of malfunction that isn't covered is age as well as typical wear and tear, which is something that is covered under a home warranty.

Your service warranty firm will after that bill you a deductible, which is the fee that you need to pay of pocket before the warrantor will certainly cover the rest of the expenses. Service warranty deductibles are usually in between $60 as well as $120 visit site for the service. Home service warranty companies, Now that you've taken into consideration the advantages and disadvantages of home warranties, right here are a few of the top residence guarantee companies.

Does a home service warranty cover old devices? A residence service warranty covers any type of defined appliances in your home, regardless of age.

The Ultimate Guide To Home Owners Warranty Insurance

Examine your contract's small print to see what elements are covered, as well as check the optimum insurance coverage restriction for cooling and also home heating devices. Keep in mind that you're responsible for any cost over this quantity. If your residence goes to danger of a/c problems, it's worth trying to find a carrier with a charitable per-item protection limitation.

Does a home warranty cover pipes? If you have a house warranty system or combination plan, it should cover your pipes system.

Some Ideas on Home Owners Warranty Insurance You Need To Know

Reading through these documents ought to give you a great suggestion of what you can get out of your strategy once you move on. Coverage exclusions, Insurance coverage inclusions as well as exclusions are where a home warranty company notes the specifics of a plan's insurance coverage. While your strategy might specify that you have coverage for broad terms like "refrigerator" or "electric," that does not always imply that all parts and components in those items are covered (home owners warranty insurance).

You might also need to offer documents to your service warranty carrier that you utilized the money payment to make the fixing. Profits, While home service warranty prepares offer insurance coverage for systems as well as home appliances, they do not constantly cover everything that can go incorrect. Prior to signing anything, constantly read your residence guarantee policy and also very carefully evaluate the great print for protection exclusions as well as limits.